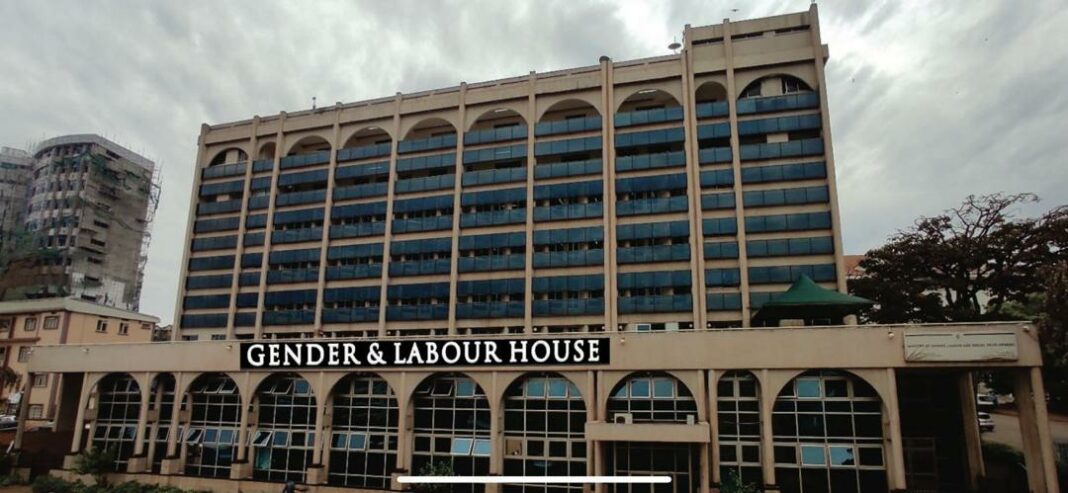

Simbamanyo House, owned by city tycoon and businessman Sudhir Ruparelia has now been renamed the Gender and Labour House.

Sudhir acquired Simbamanyo House in October 2020 after emerging as the highest bidders through his company Meera Investment Limited. The building was auctioned by Equity bank after the owner failed to service an outstanding loan of Shs 40 billion.

Meera Investments Limited bought the building at $5 million about (Shs18.5 billion).

On August 20, 2012, Equity Bank Kenya and Equity Bank Uganda granted Simbamanyo a loan of $6m (about sh21.6b). The loan was to finance the construction of a hotel at Mutungo, a Kampala suburb, and to take over a prior facility from Shelter Afrique.

The Simbamanyo building had been mortgaged by its owners with Equity Bank but after failing to pay, the exercise was conducted through public bidding on October 8, 2020 by Equity Bank Limited.

The two banks, details indicate, pooled money together with at least $3.5m drawn from Equity Bank Kenya and $2.5m from Equity Bank Uganda. However, Simbamanyo Estates challenged the outstanding sum, saying it is only aware of $7.19m (Shs26.48b).

In its defence, Equity indicates that Sambamanyo benefited and was aware of every financial transaction that was advanced to it. Equity also argued that Bank One, based in Mauritius, was drafted into the transaction on the request of Simbamanyo, which had sought to obtain bridge financing of up to $10m.

In the same spirit, Simbamanyo Estates Limited withdrew their application in which they were seeking to stop the takeover of its property on Lumumba Avenue. They had petitioned the Court of Appeal seeking orders to maintain the status quo stopping the sale of their property by Equity Bank which is seeking to recover loans worth $10.8 million (Shs40 billion).

Court documents indicate that upon issuance of the High Court order on September 7 last year, the bank advertised their property, and was meant to and finally sold on October 8.