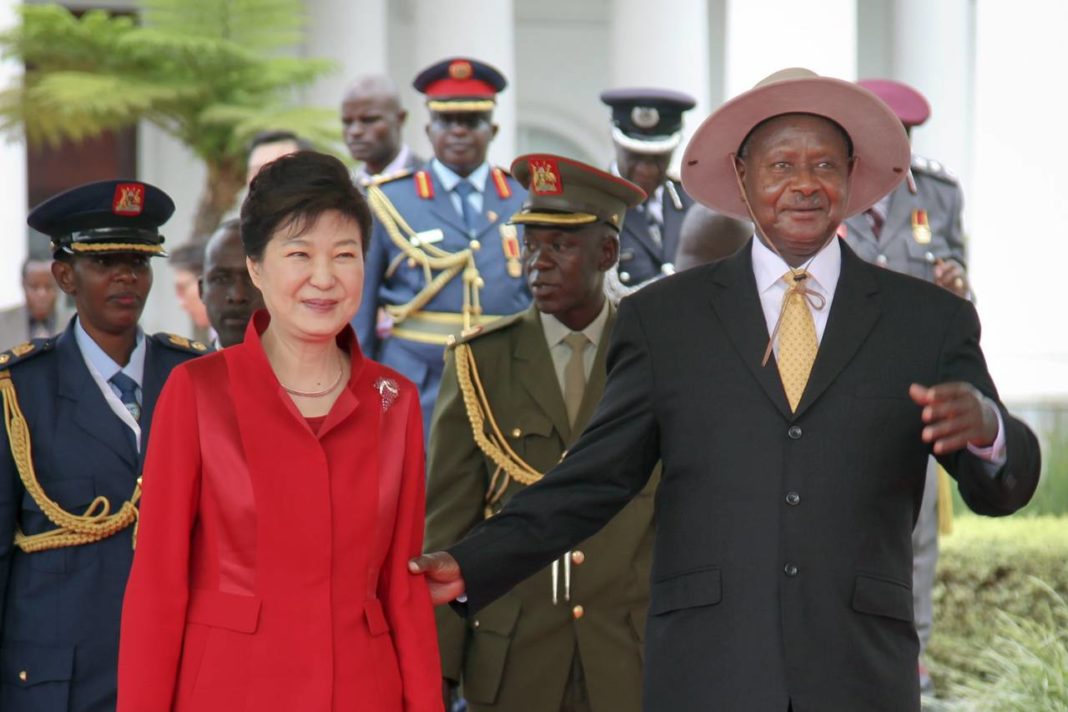

When President Museveni hosted his South Korean counterpart Park Geun-hye in May, little did the world notice that her country would benefit enormously.

By Thursday, June 30, 2016 it has been revealed that the the Energy Ministry and government had suspended negotiations with a Russian company, Rostec Global Resources Consortium, which had been offered a deal to build Uganda’s oil refinery.

A government statement released on Friday says the consortium made additional demands after a final agreement had been reached.

The contract has now been offered to South Korean company, SK Engineering, which had come second in the original bidding process.

There is speculation that the change is related to South Korean President’s visit. One senior western diplomat even said the decision to do business with a Russian military contractor whose chief executive is subject to sanctions and then dump them again “sounds typical Museveni”.

A State House insider intimates how during Museveni’s talks with Geun-hye, the man from Rwakitura was convinced that the Russians had given him a poor deal which would leave his government subsidising an inefficient refinery and could be left counting the environmental and social cost. He never thought twice before ordering for the reversal.

During the same talks, Uganda was hard-pressed cutting intomilitary ties with North Korea to comply with U.N. sanctions over North Korea’s nuclear program.

The Russian consortium which had been selected to negotiate the principal agreements had “failed to negotiate in good faith” and had “failed to execute” a shareholders’ agreement.

The Ministry of Energy and Mineral Development’s Permanent Secretary Kabagambe Kaliisa said “If RT Global choses to come back the door are still open, but we are now going to start negotiations with SK Group.” South Korea’s SK Engineering was the alternate bidder.

The 60,000-barrel-a-day refinery project, which the government estimates could cost $4 billion, includes a 205-kilometer (127-mile) oil-product pipeline. It will be fed by oil fields discovered in 2006 and estimated by the state to hold 6.5 billion barrels of crude.

The investor in the refinery will control a 60 percent stake, while the rest is for the Ugandan government, which has an option to sell some interests to partner states in the East African Community.

London-based Tullow Oil Plc, China’s Cnooc Ltd. And Total SA of France are jointly developing the crude finds.