Legitimate money Lenders urge the government to closely monitor economic activity during the Christmas season while re-opening dialogue on lending rates.

Through the Money Lenders Association of Uganda (MLAU), comprising legitimate, ethical money lenders registered with the Uganda Microfinance Regulatory Authority (UMRA), the money lenders have called for the Government and economists to reconsider the policy capping lending rates.

Legal Notice No. 21 of 2024 under the Tier 4 Microfinance Institutions and Money Lenders Act, Cap 61 issued by Finance, Planning and Economic Development Minister Matia Kasaija, recently capped the maximum interest money lenders can charge at 2.8% per month or 33.6%.

Economists and the business community have all warned that the capped rates will discourage money lenders from conducting their regular business activities as they secure long-term capital basing on prevailing free-market rates.

Various economists further raised concerns that some money lending activities could go underground, creating higher risks for borrowers – the opposite of what the Government intended to achieve.

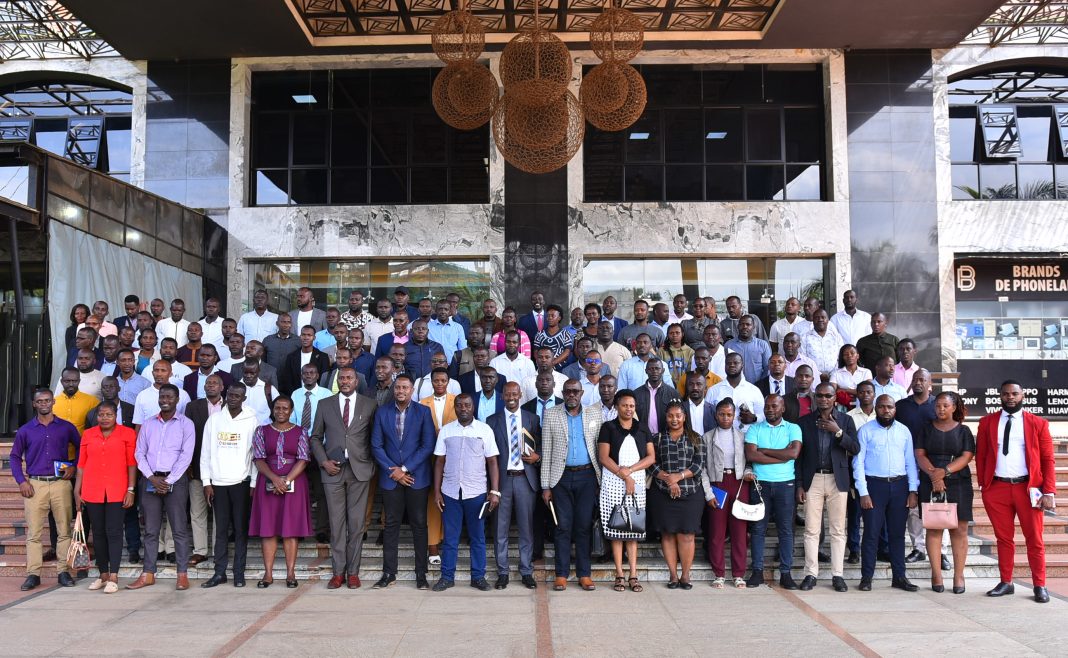

“MLAU involves ethical money lenders who have an interesting in safeguarding Uganda’s financial systems through ethical credit services to borrowers. During this Christmas season and into the new year when school fees are due, we normally see a surge in borrowing activities,” said Mr. Jonan Kandwanaho, Chair of the Money Lenders Association of Uganda.

“This time around, especially as a direct result of this new policy capping rates being introduced at such short notice, the economy is going to tell a different story. The effect will also be felt by the Government, because the constricted activity will lead to fewer taxes being paid,” Mr. Kandwanaho added.

The Money Lenders Association of Uganda (MLAU) plays a crucial role in lubricating the gears of Uganda’s economy, particularly in sectors where traditional banking services may be limited or inaccessible.

MLAU members serve as a vital lifeline for small businesses, market vendors, and entrepreneurs who rely on short-term loans to purchase inventory, bridge cash flow gaps, or seize time-sensitive business opportunities.

The Uganda Microfinance Regulatory Authority (UMRA) reports that by September 2023, 1,302 licensed money lenders had extended loans to about 2.5 Million customers, with an outstanding portfolio of Shs1.2 Trillion. This substantial figure underscores our sector’s significant contribution to economic activity. Money lenders often provide the necessary capital for farmers to buy seeds and fertilizers, for shopkeepers to stock their shelves, and for transport operators to maintain their vehicles – all essential activities that keep the wheels of commerce turning. Moreover, by offering financial services to those who might otherwise be excluded from the formal banking sector, MLAU members contribute to financial inclusion, which is a key driver of economic growth and poverty reduction. Our ability to process loans quickly and with flexible terms means that we can respond rapidly to the dynamic needs of Uganda’s vibrant informal sector, which forms the backbone of our economy.

“As we hold these discussions we should also recognise the concerns that led us to this point, and we are willing to work with the regulators to address this. We know that there are individuals within our sector whose practices may not align with the highest standards of ethical lending. We are committed to improving the overall integrity of our industry, working with all stakeholders,” Mr. Jonan Kandwanaho said.

The Money Lenders Association of Uganda believes that through constructive dialogue and cooperation with regulatory bodies and the government, we can address all concerns, improve industry standards, and continue to serve Ugandans responsibly to safeguard the country’s financial future.