2017 has had several business events and as the year comes to an end, Eagle Online brings you a recap of some of the events which made headlines.

URA says Museveni approved Shs6b ‘handshake’

In January this year, the country woke up to news from the Uganda Revenue Authority (URA) that President Yoweri Museveni approved the Shs6 billion ‘handshake’ shared between 42 highly-placed public officials.

The money was drawn from the URA coffers and the authority Commissioner General Doris Akol was also named among the beneficiaries, most of who got over Shs50 million. Other prominent beneficiaries included former URA CG Allen Kagina, KCCA Executive Director Jennifer Musisi, Finance PS Keith Muhakanizi, former Attorney General Peter Nyombi, and Solicitor General Francis Atoke.

The money that they shared out accrued from a legal challenge in which the government of Uganda sued two oil companies, Heritage Gas and Oil and Tullow Oil, and won US$700 million in compensation through international arbitration.

Following public outcry the Speaker of Parliament Rebecca Kadaga constituted a parliamentary committee and directed the Committee for Commissions, Statutory Authorities and State Agencies (COSASE) chairperson, Bugweri County Member of Parliament (MP) Abdu Katuntu, to investigate the Shs6b matter and report the findings to Parliament in two months.

However, nine months down the road, the report is yet to be produced despite the assurances by Parliament.

JANUARY: DFCU Bank ‘buys’ rival Crane Bank

One of the controversial business activities of 2017 was DFCU Bank’s ‘purchase’ of Crane Bank’s assets and liabilities in late January. The said ‘purchase’ was later to make DFCU grow its footprint by 50 percent and making a profit of Shs14 billion in half year. Needless to say however, the issues surrounding the selling of Crane Bank are before the Commercial Court and are yet to be concluded. However, city businessman Sudhir Ruparelia, one of the shareholders of Crane Bank has already floored the BoU in one aspect of the litigation, when the Commercial Court ordered BoU lawyers Timothy Masembe Kanyerezi of MMAKS Advocates and David Mpanga of AF Mpanga/Bowmans Advocates off the case for acting in conflict of Interest to the detriment of Mr. Ruparelia.

APRIL: Minister Herbert Kabafunzaki arrested over ‘bribe’

The highlight in the month of April was the arrest and suspension of State Minister for Labour Herbert Kabafunzaki on allegations of soliciting a bribe from Aya Group chairman Muhammad Hamid, whom police was investigating over accusation of sexual harassment brought against him by a former female worker.

Minister Kabafunzaki was arrested as he reportedly picked a sh5 million bribe as partial payment of sh10 million he had allegedly solicited from Hamid to ‘protect’ the businessman from sexual harassment accusations.

MAY: a) The Lotteries and Gaming Regulatory Board (LGRB) launched

On May 9 the Lotteries and Gaming Regulatory Board (LGRB) was launched at the Kampala Serena Hotel, with the Chief Executive Edgar Agaba imploring sector players to observe the strictures of gaming in Uganda.

The launch was officiated at by the State Minister for Finance (General Duties) David Bahati and also graced by the Board chairperson Manzi Tumubweine and Board Member Assistant Inspector General of Police (AIGP) Grace Akullo.

- Presidents Museveni, Magufuli sign the East Africa Crude Pipeline Agreement

-

The President Yoweri Kaguta Musevenio interacts with Tanzanian President John Pombe Magufuli

President Yoweri Museveni and Tanzania President John Pombe Magufuli in May signed the East Africa Crude Oil Pipeline agreement, an important step towards construction of the 1,445km pipeline from Hoima to the Tanga Port on the Indian Ocean. The two leaders would later in November lay foundation stone to symbolise start of the construction of the proposed USD 3.5 billion pipeline.

- Museveni deploys UPDF at UIA to catch corrupt individuals

The month of May also saw President Yoweri Museveni station UPDF officers at the Uganda Investment Authority (UIA) offices to man the 0800100770 telephone number as the ‘Anti-Corruption Hotline’ that investors would use to report those frustrating their efforts to set up business in Uganda. The soldiers would also handle complaints about delays in approving investment projects.

Foreign business delegations

The second half of the year, saw Uganda receiving delegations of investors interested in participating in Uganda’s development agenda through investments. Some of the delegations that arrived in the country came from the UK, Germany, India, China, Iran, Egypt and Netherlands among other countries. According to the Uganda Investment Authority, Uganda has business opportunities in sectors such as agriculture and agro-processing, oil and gas, ICT, energy, minerals, manufacturing, tourism, finance services, among others.

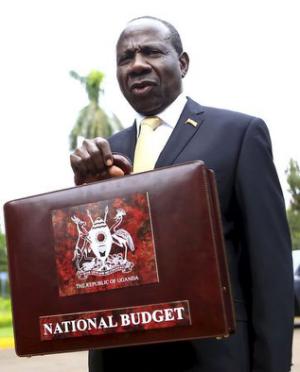

JUNE: Reading of Shs29 trillion 2017/18 Budget

In June, Uganda’s Minister of Finance, Planning and Economic Development Matia Kasaija read the largest ever Shs29 trillion national budget for the financial year 2017/18, with almost half of the money going to pay the public debt. The huge part of the remaining money went to infrastructure development projects. Commenting on the budget in Parliament, President Yoweri Museveni said his government had prioritised infrastructure development such as energy, roads and the railway to boost development.

JULY: Annual Bankers Conference 2017

Uganda Bankers Association, an umbrella body of licensed commercial banks in Uganda, held their first banking conference in mid-July at Kampala Serena Hotel, to take stock of and gain insights from global, regional and country specific issues, trends and drivers in the banking and financial services sector. Delegates also discussed the dynamics that are increasingly shaping sustainability strategies in banking and finance. This premier event attracted participants including banking and non-bank financial sector executives, fin-techs, international development partners and multi-lateral agencies, investment advisors and regulator. It also attracted research associates and academia, legal experts, legislators, policy makers, technocrats from governments. Private sector players from key sectors like agriculture, energy, tourism, housing, education, health, and telecoms also attended.

AUGUST: URA hosts ATAF

In mid-August, the Uganda Revenue Authority (URA) hosted a two-day inaugural high level tax dialogue under the African Tax Administration Forum (ATAF) at Serena Hotel, Kigo. The event was held under the theme ‘Forging the nexus between tax policy and tax administration in Africa’ and attracted officials of revenue authorities from over 30 African countries, particularly bringing in the East African regional tax bodies like the Kenya Revenue Authority, Tanzania Revenue Authority and the Rwanda Revenue Authority.

OCTOBER: a) UMA holds 25th UGITF at Lugogo

The Uganda Manufacturers Association held the 25th Uganda International Trade Fair in October, attracting local, regional and international exhibitors. As Chief Guest, President Yoweri Museveni directed officials from Ministry of Finance, UMEME, UDB, Bujagali and Uganda Investment Authority to have interactive sessions with manufacturers for better responses to their various issues of concern. UMA President, Barbara Mulwana said some issues had stagnated the manufacturers’ economic contribution. She cited the issues like the high interest rate of borrowing from commercial banks, the delayed infrastructure development of the Industrial Park, the need to refinance UDB and the high cost of capital for the manufacturing sector.

- b) Uganda hosts Giants Club Conservation and Tourism Investment Forum

Also in October Uganda hosted the Giants Club Conservation and Tourism Investment aimed at launching a new initiative to attract tourism into Uganda and make it a destination for high-end paying clients, and secure long-term sources of funding for the protection and maintenance of Uganda’s Protected Area network. Tourism has distinguished itself as a productive sector with the ability to transform Uganda from a predominantly peasant society to middle income level.

The Investment Forum specifically sough to create strategies to contribute to increase Tourist arrivals from the 1,323,000 in 2016 to 4,084,000 in 2020; foreign exchange earnings from US$ 1.371 billion to US$2.7 billion in 2020; promote job creation; and increase the contribution of tourism to GDP from Shillings 7.3 trillion to shillings 14.68 trillion at the end of the FY 2020.

- Coffee exports fetch USD564 m

The Uganda Coffee Development Authority (UCDA) in its October 2017 report said Coffee exports for 12 months (November2016 to October 2017 ) totalled 4.78 million bags worth $ 564 million comprising Robusta 3.75 million bags worth $420 million and Arabica 1.03 million bags worth $1 44 million.

The UCDA reported that Uganda’s coffee was exported to 25 destinations with the European Union, Sudan, Algeria, USA and Morocco being the top importers.

Uganda is Africa’s leading exporter of coffee much as Ethiopia leads the production of the cash crop.

NSSF beats global funds of similar size in investment performance

The National Social Security Fund (NSSF) outperformed other pension funds of its size across the globe on key investment performance indicators, according to the 27th edition of the Annual CEM Investment Benchmarking survey, commissioned by the International Social Security Association (ISSA). The survey released in November, conducted worldwide by CEM Benchmarking, was to determine the competitiveness of pension and social security funds on a global scale based on international standards on a peer-to-peer basis. The key areas assessed are Return on Investment, Net Value added and the Investment Cost. The Fund was benchmarked in a category that included 310 pension funds, with asset sizes ranging from the equivalent of Shs 2 trillion to Shs7 trillion based on the financial results for the Financial Year 2015/2016.

“I am pleased to announce that on all aspects, the Fund performed much better than its peers. A comparison of our investment returns, value added and costs to the global universe shows that we are not only competitive but we outperformed all global funds of our size. This is a vindication of our aggressive but prudent investment strategy we have implemented over the last seven years,” Patrick Ayota, the Deputy Managing Director of NSSF said.

The CII India East Africa Conclave 2017

Uganda hosted the first ever regional CII India-East Africa Conclave 2017 from November 20-21. The two-day event mainly attracted Indian businessmen with interest to invest in Uganda. Officiating at the forum at Speke resort Munyonyo, President Yoweri Museveni told the Indians that Uganda was ready for business and that this is the right time to invest in the country’s sectors such as energy, oil and gas, mining, agro-processing, ICT and finance services among others.