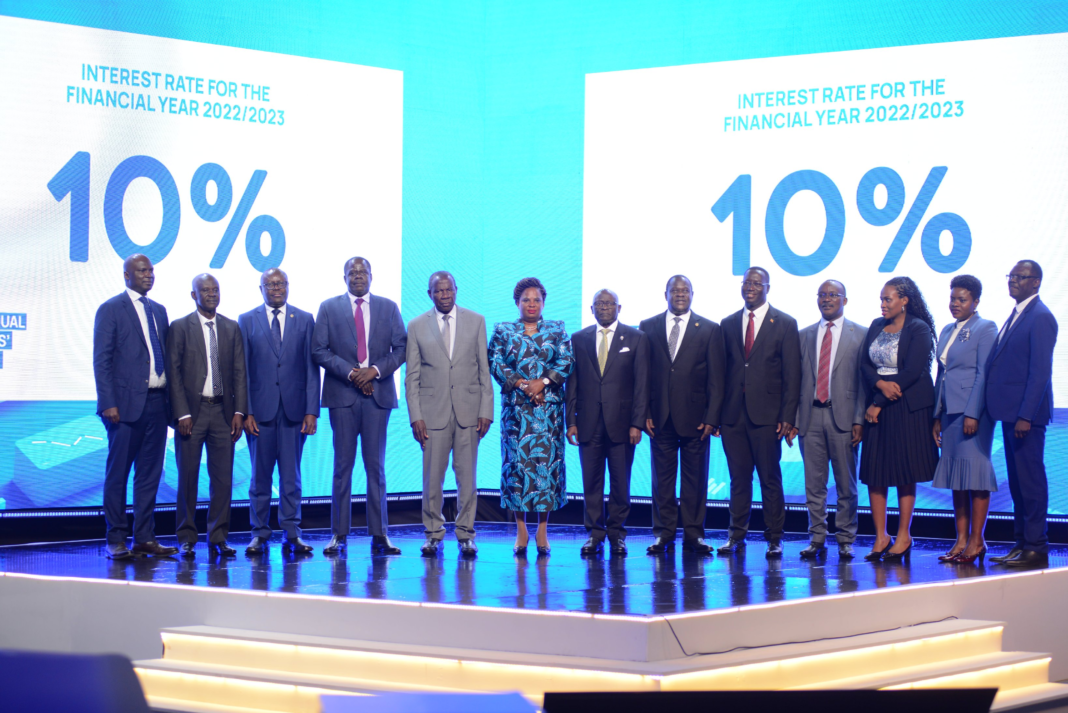

The National Social Security Fund (NSSF) has announced the interest payable to savers of 10% for the financial year 2022/23.

This new rate which equals Shs1.591 trillion shillings in total has been declared by Matia Kasaija, the Minister of Finance, Planning and Economic Development.

Last Financial Year, the 10-year average rate of inflation was 4.2%. The rate that has just been declared is 5.8% above the 10-year average, which means that the Fund has once again delivered on its promise and surpassed it by almost 3.8%.

Speaking at the event, Matia Kasaija, congratulated the NSSF Board and Management for posting a remarkable performance on almost all the Key Performance Indicators.

“I am especially glad that the Fund’s assets registered growth again from Shs17.26 trillion in Financial Year 2021/22 to Shs18.56 trillion in Financial Year 2023/24. Many naysayers did not imagine the possibility of growing this Fund to Shs20 trillion. That you will achieve that strategic objective a year ahead of schedule is laudable,” Kasaija said.

He added, “The second KPI I am interested in is the money you generated during the year because that shows the productivity of the investments that I approved during the year. I am therefore glad that the total realized income earned increased by 15% from Shs1.9 trillion in the Financial Year 2022/22 to Shs2.2 trillion in the Financial Year 2022/23.”

Kasaija revealed that this is very commendable given the turmoil in Europe due to the Russia-Ukraine war, investor flight from most of the developing markets back to the US, reduction in value across all East African stock markets and the increased scrutiny that the Fund underwent in the 3rd quarter of the just concluded financial year.

“In 2013, the Fund made a commitment to pay savers a real annual return, that is, at least 2 percentage points above the 10-year rate of inflation. I am happy to note that the Fund has consistently delivered on this commitment,” he said.

Kasaija noted that as provided for in the NSSF Act, as amended, this new rate will be calculated and credited to the balance outstanding on the members’ accounts as of 1st July 2022.

Benefits paid to qualifying members increased by 1% from Shs1.189 trillion in the Financial Year 2021/22 to Shs1.199 trillion in the Financial Year 2022/23.

The cost-to-income ratio improved from 11.7% in the Financial Year 2021/22 to 9.4% in the Financial Year 2022/23 Cost Management – our cost of administration reduced from 1.18% of total assets to 1.02%.

“NSSF is committed to broad value creation; value beyond numbers. On that note, we are launching our first Sustainability Report, which is integral to our strategy, which is working with the community,” Kimbowa said.

Patrick Ayota, the NSSF MD, said despite the internal disruptions, the Fund remained strong and resilient.

“Last year, members entrusted us with Shs1.5 trillion. This year that number went up by Shs200 billion to Shs1.7 trillion” he said.

Ayota said the Fund has 2.20 million registered members; 1.6 million have a balance, and 704,000 are active.

He also assured the savers that their savings are secure.

“The model is simple. We collect 5% from you and 10% from your employer. Then we invest it in real estate 9%, equities 13% and fixed-income 78%. 78% means that if NSSF closed today, we would pay 78% of our members within three months,” Ayota said.

“NSSF’s vision is to be the social security provider of choice. It’s important that we have the word choice there because, in our minds, we want when someone saves with NSSF, and they go back to bed, they say thank God, I saved with NSSF,” he added.

The Minister of Gender, Labour and Social Development, Betty Amongi, who co-supervises NSSF with the Minister of Finance, hailed the Fund for remaining resilient amid the difficult economic conditions in the country over the last year.

She, however, challenged the Fund to innovate and create more value for members’ savings.

“We must keep doing what we are doing very well but be brave enough to embrace and seek out new opportunities. For instance, how can the Fund innovate around health and childcare benefits, education, and insurance solutions that offer protection across the life cycles of members and their dependents?” she wondered.

“How can the Fund play a more active role in providing opportunities to the farmer, a market vendor, women, and youth groups to improve their ability to access social protection? Fortunately, the law gives the NSSF Board of Directors latitude to provide solutions to the challenge I have put forward,” she said.

Martin A. Nsubuga, the CEO of Uganda Retirement Benefits Regulatory Authority (URBRA), said return benefit schemes today hold Shs21.6 trillion of assets, of which NSSF holds Shs18.5 trillion while occupational schemes hold 3.1 trillion.

“We continue to remind members that retirement savings are long-term; likewise investment decisions should be long-term in nature. Unfortunately, this market is dominated by short-termism that determines decision-making,” he said.