Jordan Ssebuliba, about 50 years old, is an estranged son who has severally dragged his father, city businessman Mohan Musisi Kiwanuka to courts of law over the years.

He has also been bonded severally in many police stations in cases that are not related to his battles with the father.

In July 2019, Jordan Sebuliba and Lowerhill Management filed a suit (HCCS No. 555/2019) against Visa Investments Ltd. and Kiwanuka, claiming “equitable interest” in company properties. The case was dismissed.

A month later, in August 2019, Ssebuliba again sued Kiwanuka (HCCS No. 249/2019), this time seeking to take over his estate on grounds of alleged insanity. This claim was also lost

In October 2019, Sebuliba, his mother, Beatrice Luyiga Kavuma, and Lowerhill Management brought a third case against his father Kiwanuka (HCCS No. 253/2019), asserting that company properties were actually marital property. This case, too, was lost

Earlier, in March 2012, a court-ordered eviction under EXD MA 1239/2109 resulted in the removal of Sebuliba and Lowerhill Management after an 18-month legal battle.

In June 2021, Victor Nuwagaba backed by an affidavit from Mr Sebuliba filed a fraudulent purchase claim (Originating Summons No. 4/2021) on company property against Kiwanuka and Visa Investments Ltd. The court dismissed the case on grounds of a fraudulent contract.

In September 2021, Beatrice Luyiga Kavuma filed a marital claim (Civil Suit No. 182/2021) against Kiwanuka, Summit Limited, and the Registrar of Titles over company property. The suit was dismissed but marked to be rescheduled.

That same month, Visa Investments Ltd. filed a contempt of court application (Misc. Application No. 471/2021) against Jordan Sebuliba. The court ruled in favor of Visa Investments and awarded Shs100 million in damages for financial loss.

Most recently, in May 2023, four sisters of Kiwanuka—Jalia Muwanga, Yudaya Nsereko, Berti Nsereko Kawooya, and Sarah Nsereko—sought a public mental examination of their brother (HCCS No. 82/2023). This suit was dismissed on the grounds of res judicata.

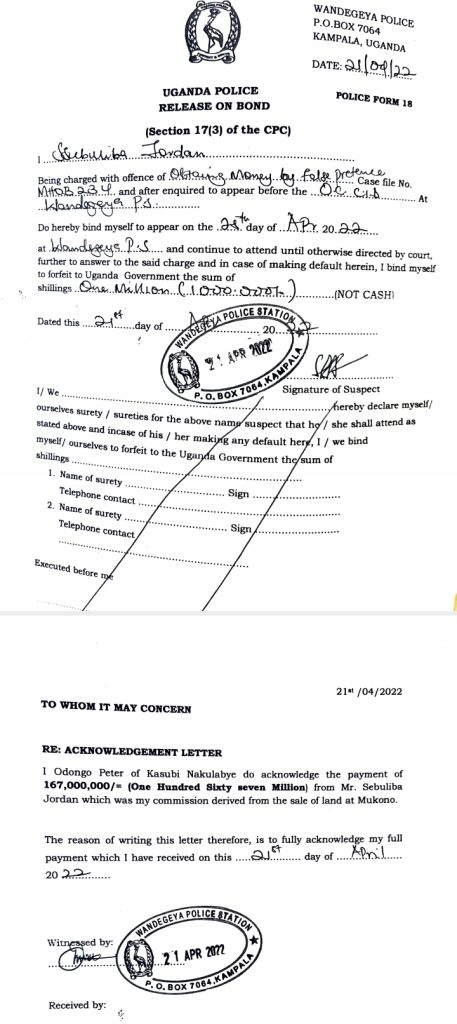

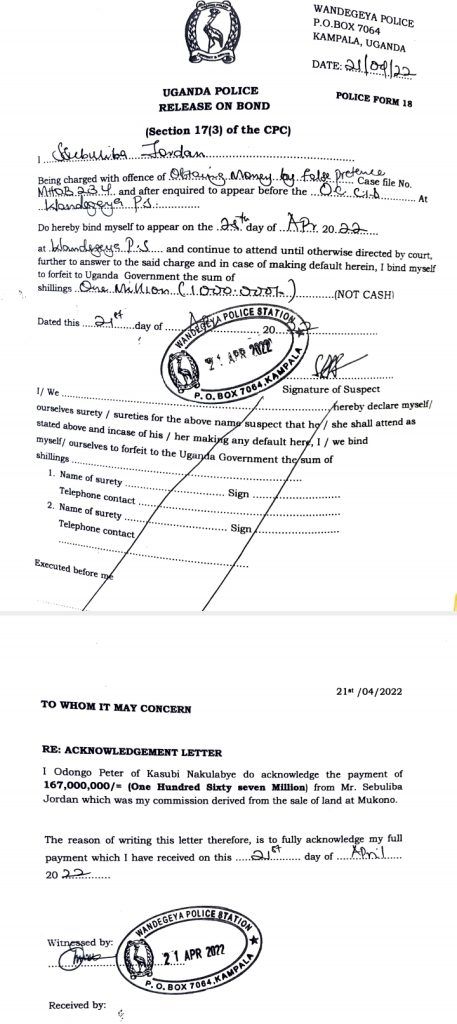

One April 21, 2021, Ssebuliba was given a release bond after being charged for obtaining money by false pretense under the case file no. MHOB 234 and was enquired to appear before the O.C CID at Wandegeya Police Station. He bound himself to appear at the station on of April 25, 2022 and failure to attend was required to pay Shs1 million. Sebuliba had falsely obtained Shs167,000,000/= (one hundred sixty-seven million) from Peter Odongo of Kasubi Nakulabye for the sale of land at Mukono.

Further, on March 18, 2024, Ssebuliba was released on bond over breach of contract under case file No.MU3 and after was required to appear before the Kira Police Station on March 20, 2025, for any default would lead him to pay shs1 million.

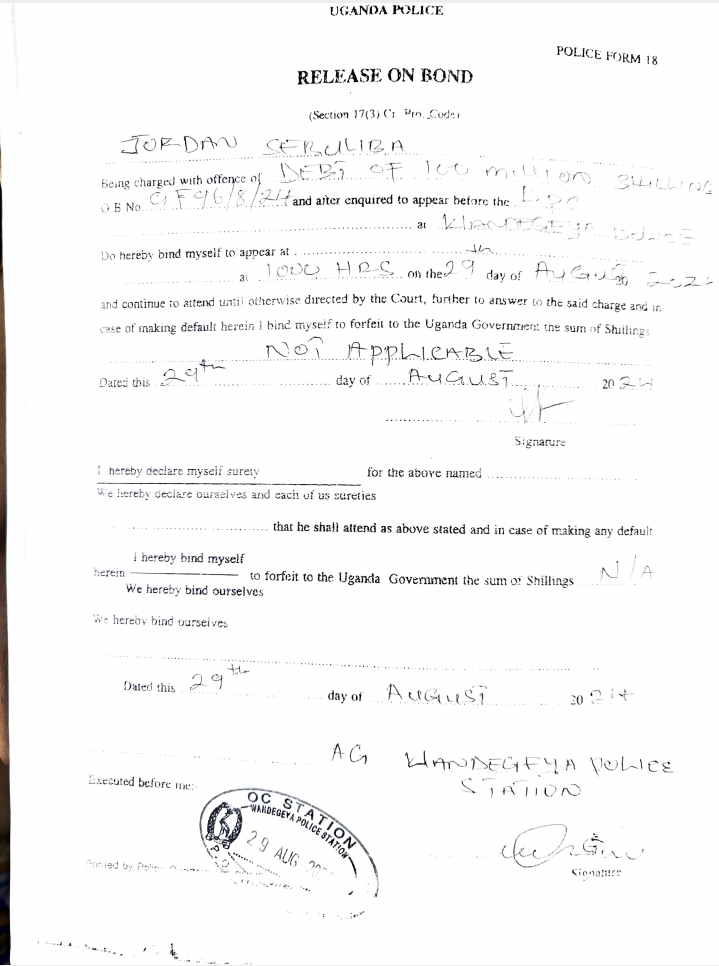

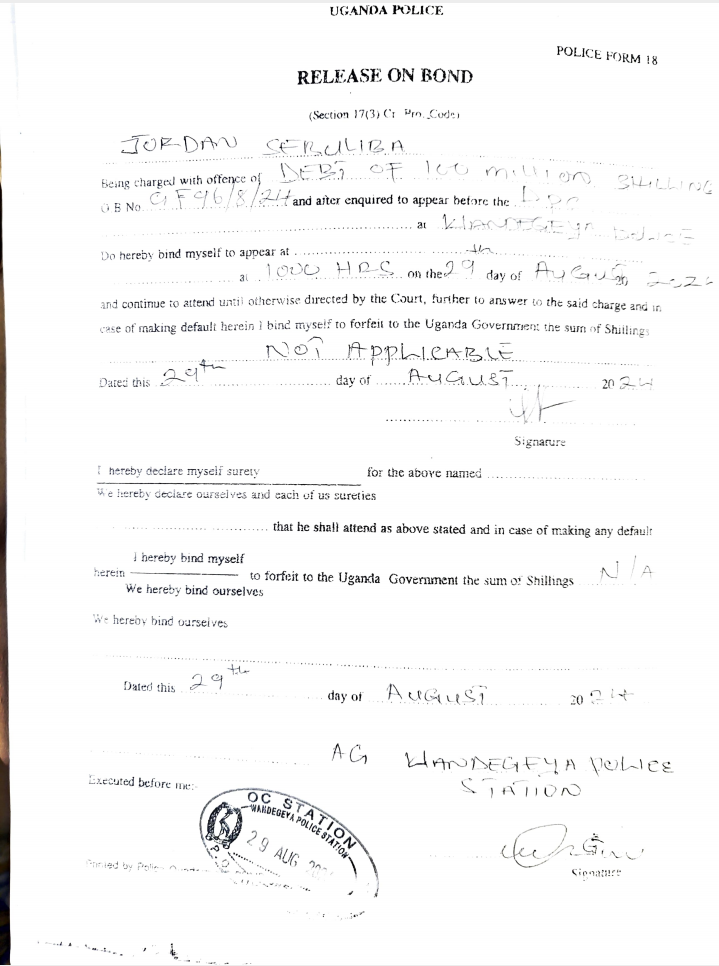

On August 29, 2024, Ssebuliba was further released on bond after being charged with the debt of Shs100 million and was enquired to appear before the DPC at Wandegeya Police Station.

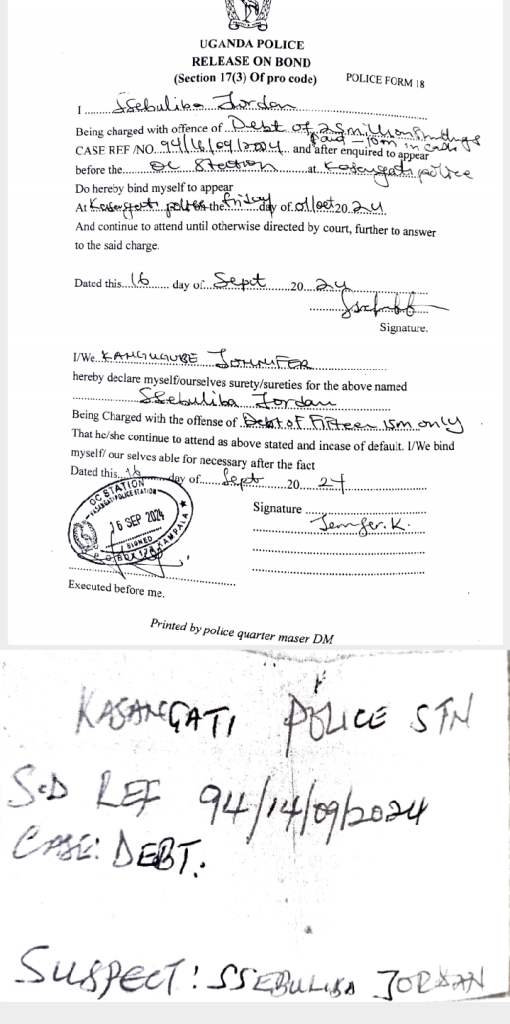

As of September 16, 2024, Ssebuliba was released on bond after being charged with debt of Shs25 million and paid Shs10m and after enquired to appear before the OC station at Kansanga Police. He bound himself to appear at Kansanga Police station on Friday, October, 1, 2024 to continue and attend until otherwise as directed by the court further to answer the said charge. A one Jennifer Kangugure declared surety and bound to pay the remaining Shs15 million.

On October 28, 2024, Ssebuliba was freed on police bond over obtaining money by false pretense and was required to appear before the CID Jinja Road.

On October 24, 2019, Mr. Kiwanuka wrote to the Director, Criminal Investigations in Kibuli addressing the dangerous actions by his son Jordan Sebuliba.

Kiwanuka noted that when he searched through the office of Oscar Industries, he uncovered the documents relating to forgery activities of Mr. Jordan Sebuliba.

‘Authorization for LOWERHILL. MANAGEMENT LIMITED to hire Plots 21-29 Golf course Road by VISA INVESTMENT LIMITED. Tenancy agreement between VISA INVESTMENT LIMITED and LOWERHILL MANAGEMENT LIMITED. Renewal of agreement for premises on plot 1-29 Golf course Road. NEMA clearance certificate for the erection of structure of house up Market Restaurant on plots 21-29 Golf course Road. Rejection by NEMA of application to construct a restaurant and lounge on plot 21- 29 Golf course road and Application for power connection (UMEME) to plot 21-29 Golf course Road’.

He revealed that these were discovered in the cabinet of Adana Damula, Ssebuliba’s sibling and these documents were unknown to the business dealings of Visa Investment Ltd and the signatories were unauthorized persons in the company. He declared that those documents were false and forwarded them to police for further investigations.

Mr. Kiwanuka wondered how a child who was raised by him comes up to claim for the properties he has no share. He questioned whether Ssebuliba had bought these properties and told him (Kiwanuka) to keep them for him.

Ssebuliba claims that Kiwanuka is mentally ill and is unable to run the managerial roles of these properties and should be taken for rehabilitation and then he takes over the ownership of the properties.

“It is just and equitable that court adjudges Mr Mohan Kiwanuka as a person of unsound mind so that his estate can be placed under proper management and that I can be appointed manager for the purpose” Mr Ssebuliba submitted to court in his application affidavit witnessed by Fabian Odongon, a Commissioner of Oaths.

And indeed, on June 19, 2025, Jordan Ssebuliba wrote to court declaring himself as dully appointed manager of the Kiwanuka estate without involving the entire family and close members.

“Two family meetings were dully convened on June 14, 2025, and June 19, 2025, during the meeting held on June 19, 2025, the lineal descendants presented appointed me as the family representative. Accordingly, I hereby forward this notice of appointment for the record of this Honourable Court” Ssebuliba submitted to Court of Appeal on June 25, 2025.

However, Mr. Kiwanuka as a parent had earlier advised Sebuliba to apologize to him and demanded for his vacant possession of the plot at Golf Course Road and another one at Akii Bua Avenue in Nakasero.

Kiwanuka was forced to make this decision following the ‘bad character’ of Ssebuliba entering into possession of his property without Kiwanuka’s acknowledgment. Noting, “You will recall that you entered into the above properties without my knowledge which no other sibling of yours has ever done. You occupied these properties for the last ten years on a commercial basis generating money therefrom without any accountability and without paying any rent.”

Kiwanuka further noted “The reason I am doing this is because that you have decided to blow my decision to take away my properties out of my proportion and to portray me amongst your and other relatives as being inconsiderate and unreasonable which is not true,”

Kiwanuka further revealed that Ssebuliba dared and suggested that his father should close and sell his factory.

“Jordan, I was greatly disappointed and hurt. You cannot phantom where I have come from and achieve whatever I have achieved and for you to have the authority to dare to suggest that I should sell my factory because in your view I can no longer manage to run it was an insult,” Kiwanuka regretted.