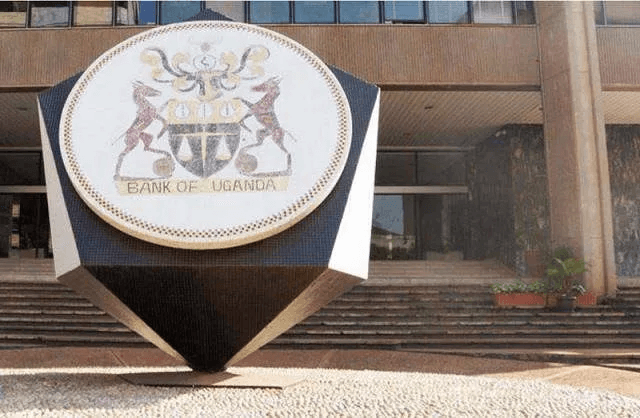

The Central Bank of Uganda (BoU) has warned the public against investment in pyramid schemes; shortly a week after several Ugandans suffered the latest Capital Chicken downfall.

The Central Bank in an advisory notice issued on Wednesday, October 04, 2023, outlined various ways in which one may detect a pyramid scheme.

“A good general rule to follow is; if it sounds too good to be true, then it is false, ” BOU said, adding that a pyramid scheme also promises consistent returns regardless of the market conditions and yet legitimate business experiences moments of profit and moments of loss.

According to the BoU statement, a pyramid scheme occurs when the company of the proprietor values attracting people to make investments more than any other thing.

“Without a constant flow of new investments to continue to provide returns to the scheme owners and older investors, the scheme falls apart,” the central Bank noted.

In such schemes, BoU says both old and new clients find challenges trying to access their money from the scheme because the money has already been spent on the proprietor or other investors.

“If a business idea cannot be explained, it is suspicious,” the country’s treasury body warned, explaining that pyramid schemes have a complex business strategy that investors are not able to understand.

The Bank of Uganda’s caution comes at a time when a recent alleged pyramid scheme by Capital Kitchen has been publicized on social media.

The company (now closed) fleeced Ugandans of billions of shillings in a non-existent investment scheme which targeted mostly the corporate class who wanted to invest in the chicken-rearing business but didn’t want to directly get involved in the business.

The Capital Markets Authority (CMA) recently noted with “great concern, an increase in the number of incidents relating to fraudulent operators and unlicensed financial schemes across the country.”

The regulator warned that “such incidents include individuals or firms holding out as investment advisers and fund managers, as well as pyramid schemes operating physically and through online platforms, which seek to take cash deposits from unsuspecting members of the public with a promise of exceptional investment returns.”

“We strongly warn the general public to avoid seeking investment advice or dealing with any unlicensed persons. Those who chose to do so at their own risk,” CMA emphasised.